Top Project Budget Tracking Software Tools Reviewed

Project budget tracking is no longer a back-office task — it’s now a critical driver of on-time delivery, stakeholder trust, and financial control. In 2025, with globally distributed teams, real-time expenses, and fluctuating resource rates, relying on static spreadsheets or outdated systems can wreck margins and undermine project outcomes. That’s why selecting the right budget tracking software is no longer optional — it's strategic armor.

This guide cuts through the noise and reviews the top budget management platforms that excel in cost forecasting, multi-currency handling, reporting flexibility, and real-time visibility. Whether you're leading agile sprints, enterprise builds, or global rollouts, this comparison will arm you with actionable clarity to choose the best-fit tool for precision budgeting at scale.

What to Look for in Budget Tracking Tools

Choosing the right project budget tracking software hinges on more than just interface design or price — it’s about how precisely the tool mirrors real-world budget dynamics. You need solutions that anticipate cost risks, reflect real-time financial health, and proactively prevent budget overruns. Below are the core features that separate high-impact platforms from generic ones.

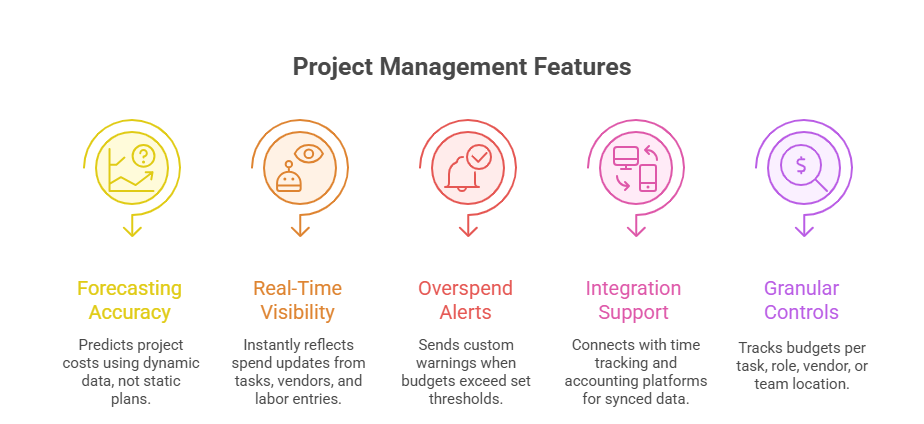

Forecasting Accuracy

Accurate forecasting is foundational for proactive budget control. Tools must offer dynamic projections that update as tasks shift or rates change. Rigid forecast models collapse under agile delivery. Leading platforms ingest historical spend, actual burn rates, and upcoming scope changes to adjust forecasts automatically.

The best tools integrate earned value management (EVM) and predictive cost-to-complete calculations.

AI-enhanced platforms can analyze delays and resource changes to auto-adjust financial trajectories.

Forecasting that excludes vendor rates, currency drift, or past variance is functionally blind.

Without live reforecasting, your initial budget becomes irrelevant within weeks — a dashboard of false confidence.

Real-Time Cost Visibility

Static reports aren’t enough. Live financial visibility lets you take corrective action before costs derail outcomes. Strong platforms sync in real-time with time logs, procurement systems, and labor costs.

Visibility must be granular down to task, team, and region — not just total burn.

Cost dashboards should highlight variance thresholds in visual formats, not buried in spreadsheets.

Daily auto-refresh on expense data (via integrations with tools like QuickBooks or Xero) is now baseline.

Real-time visibility means you’re not guessing whether you’re off track — you know, instantly.

Alerts & Overspend Triggers

Preventing a budget crisis is better than reacting to one. Your tool must include customizable alerts that flag when costs exceed defined parameters.

Alerts by task, phase, or vendor ensure proactive intervention.

You should be able to trigger warnings for labor hours, material purchases, or underreported billable time.

Some tools allow smart escalation rules — if a phase runs 10% over, it notifies PMs; at 15%, finance is looped in.

Alerts are the early warning system that separates tools built for show from those built to safeguard your margins.

Top Budget Tracking Tools Compared

The project budget tracking software landscape is crowded, but only a few platforms consistently deliver real-world value at scale. Below is a focused comparison of standout tools trusted by project managers, finance teams, and operations leaders for cost control. Each offers a distinct set of capabilities suited to different project types, from agile sprints to capital-intensive rollouts.

Float

Float is a powerful resource management and budgeting platform built for teams that scale. It shines in capacity-based cost planning, letting you assign hourly rates to team members and forecast project budgets in real-time.

Features include resource forecasting, live availability tracking, and granular role-based budgeting.

Integrates with tools like Asana, Trello, and Slack to sync timelines and allocations with cost layers.

Ideal for agencies and consultancies that require rate-based cost mapping across multiple clients or projects.

Float doesn’t overcomplicate — its visual scheduling grid and intuitive budget breakdowns make financial forecasting fast and accurate.

Toggl Plan

Toggl Plan merges lightweight planning with cost visibility for lean teams. It’s not a full ERP substitute but is exceptionally well-suited for freelancers, small dev teams, and startup operations.

Budgeting works on effort estimation tied to hourly cost rates, giving you burn rate forecasts without enterprise-level complexity.

It integrates seamlessly with Toggl Track for time-to-cost conversion, making labor-based budgeting automatic.

Less suitable for procurement-heavy or multi-currency projects, but excels at time-aligned project costing.

Toggl Plan favors simplicity — perfect for project leads needing just enough financial control without spreadsheet maintenance.

Wrike

Wrike is built for enterprise project management and includes strong budget tracking features embedded within its work breakdown structure.

Financial controls include custom fields for cost entries, time tracking, and role-based spend approvals.

Works well across marketing, IT, and operations departments — especially when budget controls need to be customized per team.

Real-time Gantt charts + cost widgets offer synchronized planning and spend tracking.

Wrike stands out for teams needing to blend execution and finance visibility within the same interface — reducing toggles between systems.

Zoho Projects vs. Microsoft Project

These two tools cater to different ends of the complexity spectrum, but both offer solid budget tracking options.

Zoho Projects

Designed for affordability, Zoho provides built-in budgeting via task costing, time tracking, and simple invoice generation.

It supports integrations with Zoho Books and CRM for end-to-end financial workflow.

Microsoft Project

Known for detailed Gantt charts and PMO-level control, MS Project lets you define baseline budgets, set cost resources, and track actuals vs. forecast.

However, it's less flexible for real-time updates and lacks native multi-user simplicity.

If you want scalability and integration flexibility, Zoho wins. For detailed control in a structured environment, Microsoft Project is stronger — but only if your team can manage the learning curve.

| Tool | Best For | Core Budgeting Features | Integrations | Limitations |

|---|---|---|---|---|

| Float | Agencies, consulting teams, resource-based planning | Hourly rate forecasting, resource cost tracking, role-based budgeting | Asana, Trello, Slack, Google Calendar | No native tax compliance or deep multi-currency handling |

| Toggl Plan | Freelancers, startups, small teams | Time-based cost estimation, simple budget projections | Toggl Track, Slack, Google Calendar | Not ideal for procurement-heavy or multi-phase enterprise projects |

| Wrike | Enterprise teams, cross-functional project ops | Task-based budgeting, time tracking, spend approvals, custom cost fields | Salesforce, QuickBooks, MS Teams, Google Drive | Learning curve; best value at premium tiers |

| Zoho Projects | SMBs needing integrated workflow + finance | Task costing, billing reports, basic invoicing, CRM integration | Zoho Books, Zoho CRM, Zapier | Basic forecasting and reporting features vs. enterprise tools |

| Microsoft Project | PMOs, engineering, IT infrastructure projects | Baseline budgeting, cost resource allocation, actual vs. forecast tracking | Power BI, SharePoint, Dynamics 365 | Steep learning curve, limited collaboration features for non-technical users |

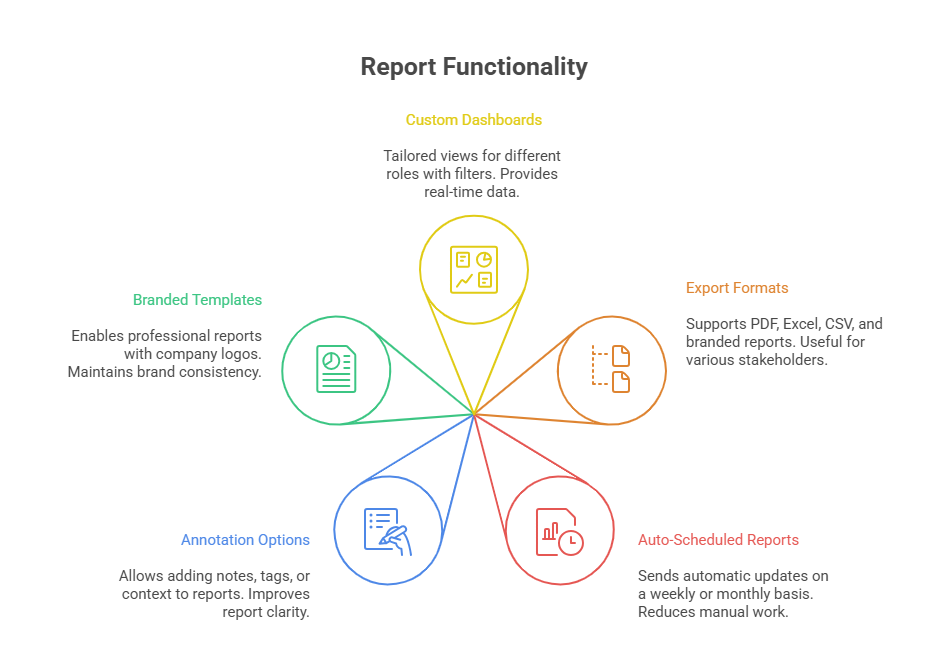

Custom Reporting & Export Capabilities

Budget tracking tools are only as good as their ability to communicate numbers to stakeholders. Without robust custom reporting and flexible export options, even the most accurate data becomes useless. Decision-makers need context-rich views, timely summaries, and delivery-ready formats to act fast and report up. Here’s what to demand.

Custom Dashboards

Custom dashboards are more than a design preference — they enable targeted visibility. You should be able to build role-based dashboards that show only what's relevant to that user: execs want burn vs. baseline, while project leads need task-cost alignment.

Look for drag-and-drop widgets, real-time filters, and the ability to break down cost by milestone, vendor, or region.

The best tools let you set saved views — for example, “Overhead Only” or “Invoiced Tasks This Month.”

Customization helps declutter noise, allowing faster budget intervention and clearer financial strategy alignment.

Dashboards should serve your structure — not the other way around.

Stakeholder Reporting Formats

Export flexibility is where many tools fail. Your budget tracking platform must allow automated and manual exports tailored to who’s reading them — CFOs, clients, auditors, or department heads.

PDF, CSV, Excel, and direct email outputs are now minimum standards.

Look for branded report templates, dynamic date ranges, and annotations to add project context.

Some platforms allow you to auto-schedule report sends, so no weekly reminder is needed.

Tools like Wrike and MS Project support advanced exports, but platforms like Float and Zoho win when it comes to ready-to-send client summaries.

Whether you're sending burn summaries to clients or syncing cost data with finance, export features make or break reporting flow.

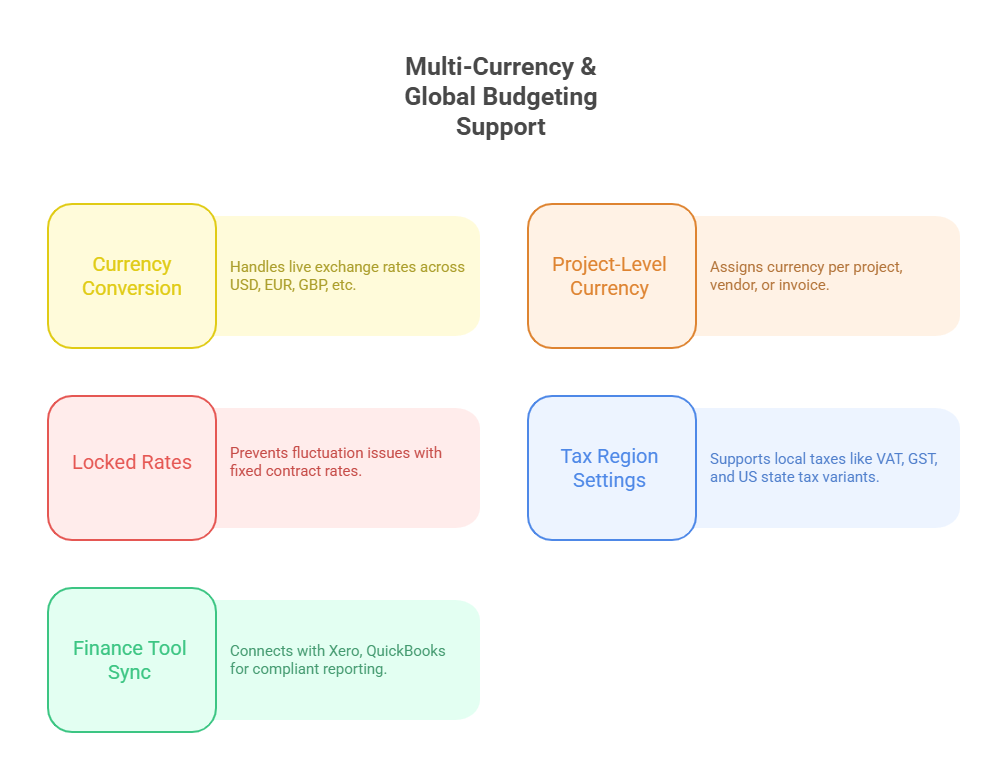

Multi-Currency & Global Budgeting Support

For global teams, vendors, or clients, multi-currency support isn’t a nice-to-have — it’s essential. Projects now span countries, billing systems, and tax codes, which means your budget tracking software must natively understand financial complexity. The wrong tool here means errors in invoicing, reporting, and forecasting that can cost you thousands.

USD, EUR, GBP Handling

At minimum, the platform should support the major currencies used across North America, Europe, and the UK. But support isn’t just about adding symbols — it’s about real-time currency conversion and historical rate accuracy.

Best-in-class tools like Zoho and Wrike allow users to tag currencies per task, vendor, or invoice, auto-convert into base currency, and lock exchange rates at the time of contract.

Systems should offer multi-currency dashboards so project managers in different countries see values relevant to their location.

Tools that allow currency selection only at the account level (not per project or vendor) limit real operational use.

You need flexibility in how costs are entered, stored, and converted — not just basic toggles.

Cross-border Taxation

If your project spans countries, taxation rules vary wildly — VAT in the EU, GST in Australia, withholding rules across Asia. Without built-in handling or integration with compliant finance tools, you're stuck with error-prone manual adjustments.

The most robust platforms allow for region-specific tax tags, so that estimates and invoices reflect real payable totals.

Some allow custom tax field creation, which is critical for industries with layered regulatory compliance.

Look for tools that sync with accounting platforms like Xero or QuickBooks for country-specific tax compliance.

Cross-border budgeting isn’t solved with spreadsheets. Your tool needs native intelligence to prevent legal risk and deliver margin accuracy.

Case Studies: Budget Wins and Fails

Knowing what project budget tracking software can do is helpful — but seeing where it either saved or sank a project makes it real. These two brief case studies show how tools impact budgets at scale — both positively and disastrously.

Large Construction Project: Overspend Prevention in Real Time

A global construction firm managing a $22M residential development in the UAE implemented Wrike with cost control modules. Prior to Wrike, the team was using spreadsheets synced weekly across departments — delays in reporting led to material costs being recorded days after delivery.

After implementation:

Real-time material cost dashboards were linked directly to procurement approvals.

Wrike’s task-based cost fields were tied to delivery milestones and updated daily.

Overspend alerts were triggered when subcontractor hours exceeded initial estimates by 12%.

Result: The team prevented $450K in projected cost overruns, avoided penalties from late delivery, and stayed 3.8% under budget. The PMO credited live budget monitoring as the difference-maker.

Tech Product Launch Budgeting: Failure Due to Rigid Tools

A mid-size SaaS company planned a product launch with a $750K budget, split across dev, marketing, and compliance. They opted for a lightweight task management tool without real-time financial integration — assuming manual Excel tracking would suffice.

Within 6 weeks:

Vendor costs weren’t reflected in dashboards, so burn rate was underestimated by 28%.

No automated alerts meant paid ad campaigns continued overspending for 9 days.

Currency mismatch between EU marketing partners and USD invoices led to ~$18K in exchange loss and rework.

Final result: The launch went 17% over budget, delaying the rollout and forcing reallocation from Q4 initiatives. Leadership replaced the tool with a dedicated budget tracking platform before the next release cycle.

These case studies prove a simple truth: tools don’t just track costs — they determine whether you're in control or just reacting.

| Project | Industry | Tool Used | Outcome | Lesson Learned |

|---|---|---|---|---|

| UAE Residential Construction | Construction | Wrike | Saved $450K by flagging subcontractor overspend in real time | Live material cost tracking prevented overruns and late penalties |

| SaaS Product Launch | Technology / Software | Basic task tracker (no financial integration) | 17% over budget, delayed rollout, $18K lost in exchange rate errors | Lack of real-time cost visibility and multi-currency support caused compounding losses |

| Global DevOps Migration | IT / Infrastructure | MS Project | On-budget delivery, accurate forecasting through baseline controls | Baseline budgeting combined with actuals tracking kept scope aligned with spend |

| Creative Agency Rollout | Marketing / Services | Float | Improved client billing accuracy, 12% more revenue retained | Rate-based forecasting exposed billable hour leakages early |

| Event Management Campaign | Events / Hospitality | Toggl Plan | Overspent by 10% due to lack of vendor-specific alerting | Lightweight tools need augmenting with manual cost controls in high-variable scenarios |

How APMIC Certification Helps with Budget Oversight

Even the most advanced tools fail if the person operating them lacks project financial fluency. That’s where the APMIC Advanced Project Management Certification makes the difference — it trains professionals to not just use budget tracking software, but to master the decision-making that drives cost control.

Through over 500+ modules, the program covers:

Project financial planning, including baselines, forecasts, and earned value calculations.

Hands-on simulations using tools like Microsoft Project, Wrike, and Zoho Projects for live budget scenario management.

Frameworks for risk-adjusted budgeting, stakeholder cost reporting, and scope-finance alignment.

Graduates of the APMIC certification routinely report increased confidence in preventing budget overruns, defending estimates, and aligning forecasts to real-world changes. The program’s CPD-accredited content ensures alignment with global budgeting standards and PMI-recommended practices.

Frequently Asked Questions

-

The top features to prioritize are real-time cost visibility, forecasting accuracy, and custom reporting. Look for tools that integrate with your project management and finance stack, allowing automatic updates to budgets as resources shift or timelines extend. Automated alerts for cost overruns, support for multi-currency handling, and dashboards tailored to different stakeholders are essential for managing large or multi-phase projects. Without these features, you’ll be stuck in reactive mode, constantly revising estimates instead of preventing overspending.

-

The best project budget tracking tools offer native integrations with platforms like QuickBooks, Xero, SAP, or Oracle NetSuite. This allows seamless synchronization of payables, labor costs, invoices, and vendor payments directly into your project financials. Some tools also support API access, enabling customized integrations for in-house systems. Real-time sync ensures your budget reflects actual cash flow, not just planned numbers. This prevents discrepancies during audits and gives finance teams full oversight across departments without duplicating data entry.

-

They can be — but only for very small teams or limited-scope projects. Free versions of tools like Toggl Plan or Zoho Projects offer basic budgeting through task-level cost entry or time-based estimation. However, they often lack advanced features like multi-currency conversion, tax compliance, granular forecasting, or stakeholder-specific reporting. For freelancers or startups, these tools might be sufficient. But as soon as you manage multiple clients, contractors, or departments, the absence of real-time data and cost visibility will become a serious liability.

-

Projects that span international teams, vendors, or markets must handle currency differences accurately to avoid misbudgeting. Good tools allow you to assign currencies per vendor, invoice, or project task, and convert amounts using live exchange rates or locked rates for contracts. Without this, fluctuating exchange rates can distort budget reports and cause issues with forecasting and reconciliation. Proper multi-currency handling ensures your total cost picture remains stable and reliable — especially for companies billing or paying in USD, EUR, GBP, or beyond.

-

Forecasting involves predicting future costs based on scope, rates, and delivery timelines — it sets the budget expectation. Real-time tracking, on the other hand, compares current expenses against that forecast using live data from time tracking, purchases, or resource usage. While forecasting sets the baseline, tracking tells you if you're meeting it. Without both, your project either flies blind or lives in the past. High-quality tools use real-time tracking to automatically refine forecasts, so your budget projections evolve with your project.

-

Yes — if the tool includes tax field customization, regional templates, or integration with accounting platforms. For global or cross-border projects, taxation rules differ significantly — especially with VAT, GST, or withholding taxes. Tools like Wrike or Zoho allow the application of tax rates at task or vendor levels. Others integrate with tax-compliant finance software that handles region-specific rules. This ensures your project reports reflect true financial obligations, minimizing risk during audits or when working across borders with different compliance standards.

-

Absolutely. Most enterprise-grade platforms support role-based permissions, allowing control over who sees what. Project managers might see cost vs. forecast, team leads view only time logs, and clients access high-level spend summaries. This ensures financial data confidentiality while still maintaining transparency where needed. Tools like Wrike, MS Project, and Float let you define access at the user level, down to specific reports or cost fields. It’s a critical feature for maintaining control over budget data without disrupting operational collaboration.

-

The Advanced Project Management Certification by APMIC trains professionals to think strategically about budgets — not just track them. It covers earned value management, real-time forecast analysis, reporting formats, stakeholder budget communication, and risk-adjusted planning. You learn how to choose and configure the right tools, apply metrics that matter, and justify costs to executives or clients. With over 500+ modules and live simulation exercises, the program ensures you're not just operating tools — you're leading financial outcomes across every project phase.

The Take Away: Maximize Budget Control

Project success isn’t just about deliverables — it’s about financial precision. The right budget tracking software gives you real-time control, predictive insight, and the ability to respond before problems spiral. But tools alone won’t save you. Mastery comes from knowing what to track, when to intervene, and how to turn data into decision-making power.

Whether you're managing a lean tech sprint or a global construction rollout, combine the right tool with strategic project training — like the APMIC certification — to ensure every dollar aligns with your project vision. Precision isn’t optional anymore. It’s your edge.